- American Express offers has a new card linked offer for $75 back or 7,500 SkyMiles on $200+ in cumulative Delta airfare purchased by August 15. So far these have only been seen on Delta co-branded cards.

Delta makes this offer easier to game than most airlines. - Do this now: Register for 3x United miles at IHG properties through August 31 for stays booked by June 30 for up to 15,000 earned miles.

IHG points convert to United miles at 2 miles per dollar normally, which means 6x under this promotion. - Kroger.com has 5% off of most third party e-gift cards with promo code MAYMADNESS through Saturday, including travel favorites like Delta, Uber, and airbnb. You’ll also earn 4x fuel points on these purchases.

1,000 fuel points is worth between $15 and $25 on average, though you can get up to $35 in value. The Daily Churn has a great episode on maximizing Kroger fuel points. So, you can think of those as an additional ~7% off on average. - Kroger has a 4x fuel points promotion today only on third party gift cards excluding Amazon. Pepper Rewards continues to depress the market, but there’s a growing sentiment with several data-points suggesting that Pepper’s insanity will end before June does.

- Staples purportedly has fee free $200 Mastercard gift cards starting Sunday and running through the following Saturday, limit five per transaction. I can’t actually find this offer in the weekly ad so double check before buying, but they did run the promotion last year for the same week so it’s likely real. (Thanks to GCG)

- The American Express Morgan Stanley Platinum card has a 125,000 Membership Rewards sign-up bonus after $8,000 spend in six months, which matches the previous high offer for this card. There are a few reasons to care about this card, principally:

– It’s historically been more churnable than other Platinums

– It offers an authorized user Platinum card with no additional fee, including lounge access

You need a Morgan Stanley account to be eligible. Current accounts that should qualify include Platinum Cash+, AAA, Access Investing, or a company retirement account.

Have a nice weekend friends!

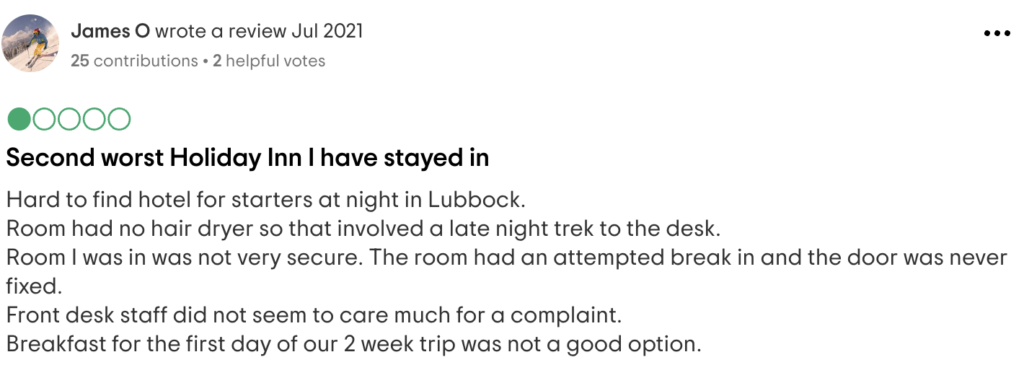

Good news on two fronts for Lubbock Holiday Inn guests: (1) It’s not the worst Holiday Inn, and (2) you’ll earn 3x United miles.